In the ever-evolving real estate dynamics, recent developments in interest rates are reshaping the market. As dedicated realtors in North Vancouver, understanding the implications of these interest rate cuts are crucial for both industry professionals and homeowners seeking their perfect abode. Let’s take a look into the insights provided by the recent Better Dwelling article.

Continue reading →Rates

Exploring Canadian Economic Trends: Impact on Real Estate

Amidst evolving Canadian economic trends, marked by inflation and growth concerns, we delve into the potential ramifications for the real estate market in this blog post. As Canadian Economic Trends shape the landscape, we’ll explore how recent economic changes might affect homeowners, homebuyers, and sellers in today’s Better Dwelling article.

Continue reading →

Canadian Real Estate Trends: A Balancing Act

In line with current Canadian real estate trends, as reported in today’s Better Dwelling article, the impact of higher interest rates is reshaping the market landscape. The recent release of Canadian Real Estate Association (CREA) data for September reveals a decline in existing home sales, but there’s more to uncover in this evolving narrative. We’ll delve into the shifting market dynamics and their implications for homeowners, homebuyers, and sellers.

Continue reading →

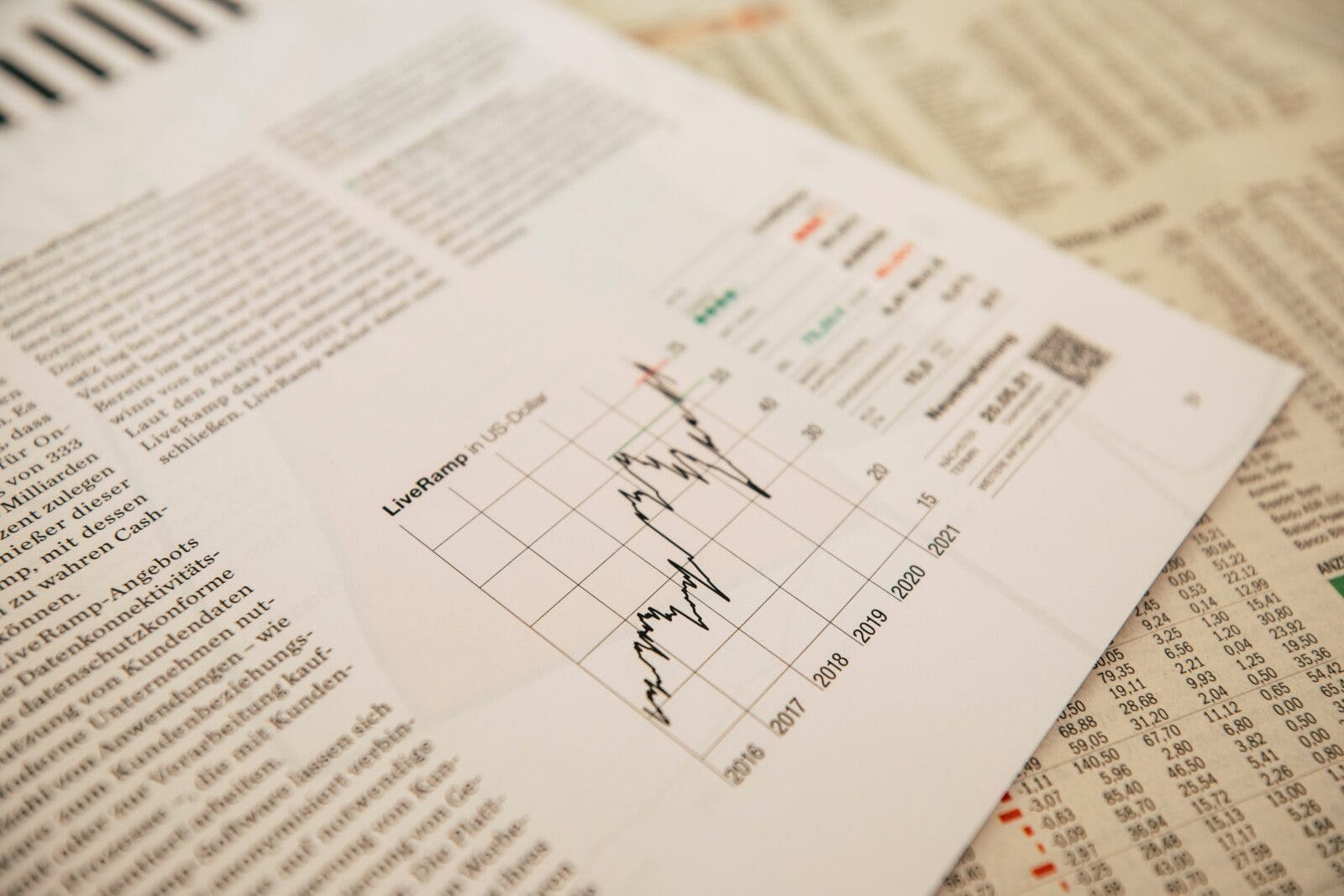

Canadian Real Estate: High Prices and Rising Rates

According to a recent Better Dwelling article, Canadian interest rates are surging higher, creating a significant hurdle for real estate prices. Last week, former Bank of Canada (BoC) Deputy Governor, Paul Beaudry, made a thought-provoking statement on the relationship between home prices and current interest rates. In this blog, we’ll explore this intriguing perspective and its implications for the Canadian real estate market.

Continue reading →

Canada’s Rising Bond Yields: What It Means for Real Estate

Canada’s bond yields are on a relentless ascent, posing significant implications for the real estate landscape. The rising bond yields are pushing mortgage costs higher. This surge in rates is unique because it’s likely to persist for a more extended period than in the past two decades.

Continue reading →

Rising Bond Yields Impact: The Challenge for Canadian Interest Rates

The Government of Canada’s (GoC) 5-year bond yield is reaching multi-year highs, affecting borrowing costs for homeowners. The global trend of “higher for longer” interest rates prompts a major Canadian bank to scale back rate cut forecasts. Read on for more on how the rising bond yields impact Canadian interest rates.

Continue reading →

Housing Affordability and Rates: Impact on Canadian Buyers and Sellers

The impact of Canadian housing affordability and rates has been a topic of discussion for quite some time now, with affordability being a key concern. Recent headlines have fueled these concerns, but let’s take a closer look at the data to understand how it’s impacting both home buyers and sellers.

Continue reading →

CASHBACK MORTGAGE FINANCING

As the name implies, a cashback mortgage is similar to a standard mortgage, except that you receive a lump sum of cash upon closing. This lump sum will either be a fixed amount of money or a percentage of the mortgage amount, usually between 1-7%, depending on the mortgage term selected.

Continue reading →

Simplifying The Mortgage Process

Chances are, buying a home is one of the most important financial decisions you’ll make in your life. And as mortgage financing can be somewhat confusing at the best of times, to alleviate some of the stress and to ensure your home purchase goes as smoothly as possible, here are six very high-level steps you should follow.

Continue reading →

Why You Should Work With An Independent Mortgage Professional

If you need a mortgage, working with an independent mortgage professional will save you money and provide you with better options than dealing with a single financial institution. And if that is the only sentence you read in this entire article, you already know all you need to know.

Continue reading →